Break Event Point ResultĪfter completing both Fixed and Variable Cost section, you can define your sales price target. You can modify current category in this template. There are many materials that can be classified in this Variable Cost category.

On the other hand, if you produce less mobile phones, you need to purchase less. If you produce more mobiles phones, you need to purchase more. For example, to produce 1000 mobile phones you need to purchase 1000 boxes and print 1000 user guides. Why this cost is considered variable? Because you won't expense money if you don't produce it. The excel formula will calculate the total cost needed to produce all units. You must fill the amount in per Unit column. Then, you can put variable costs for the products. The excel formula will calculate its cost per unit at the left side of inputted amount. Type the production capacity in Units and fixed costs in Dollar (you can change to other currency from formatting cell menu). You must pay your employees regularly, doesn't it? You can modify current categories with yours. Fixed cost means cost that you must expense monthly regardless of number of units being produced or sold. This number corresponds with a number of employees, company space, machine investment (for depreciation), and many other expenses category that will be classified as Fixed Costs. In this template, you can see production capacity is put on top of the table.

#Break even analysis how to#

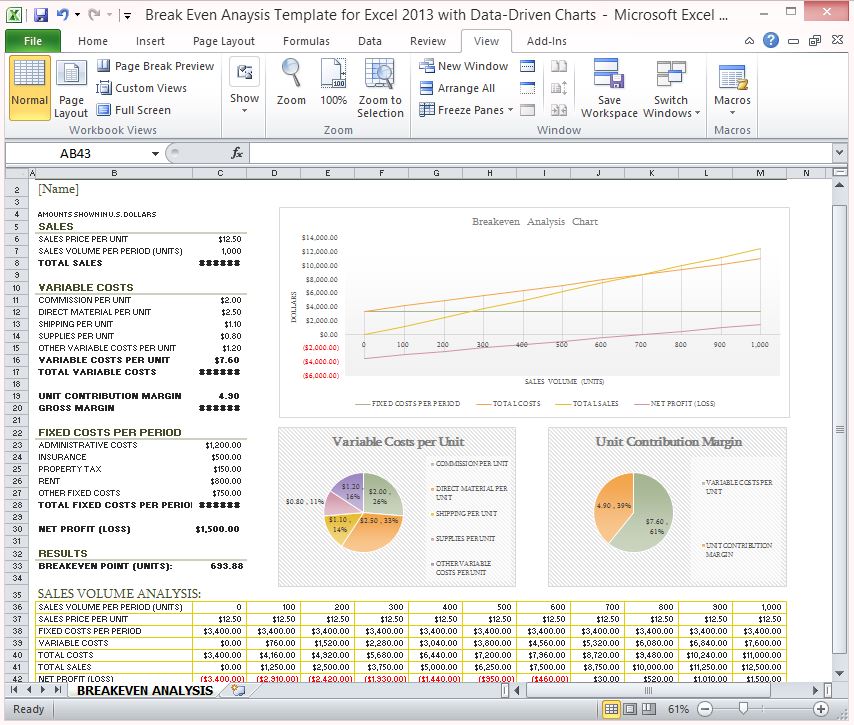

How to Use Break Even Analysis Template for Excel Fixed Cost Table Now, let's see how to use the template with above logic and equation. You can convert this number to revenue number by multiplying it with its sales price. Since the price per unit minus the variable costs of product is also called the contribution margin per unit, the equation above can be written as follow :īreak Event Point in Units = Fixed Costs/Contribution Margin per Unitīy putting all required numbers, you can get a number of units that you must sell to cover all of your business expenses. The break-even point formula is calculated by dividing the total fixed costs of production by the price per unit less the variable costs to produce the product.īreak Event Point in Units = Fixed Costs/(Sales Price per Unit - Variable Cost per Unit) Let’s take a look at a few of them as well as an example of how to implement it in the Excel template. There are many different ways to apply this concept in Excel.

In a more detail definition, break event point is calculated by comparing the amount of revenues/sold units with fixed and variable costs associated with those generated revenues/sold units. Financial people should already understand it well. There are logic that you have to understand before using this excel template. Still, there are many things that have to be considered to gain more profit and it could be different among different type of businesses. I created this simple break even analysis template to help you calculate it correctly. That's why some companies need to plan their products and sales carefully to avoid that loss. On the other hand, your company suffer loss if it failed to reach that break even point number. Your company gains profit if your revenue is above break even point revenue. One month is a common period to measure it. Break even is used to define whether your business revenue can cover all of your expenses within particular time period.

0 kommentar(er)

0 kommentar(er)